MUNICH and LONDON – April 10, 2025 – IDnow, a leading identity verification platform provider in Europe, is evolving its role in the digital identity landscape, ushering in a new phase of growth centered around trust, security, and future-proofing.

Where Trust Powers Identity – this phrase encapsulates IDnow’s evolution from a European leader in automated and expert-led identity verification to a forward-thinking, future-proof digital identity ecosystem. This ecosystem not only verifies identities but continuously enriches them, setting a new benchmark for trust and security in the digital world.

IDnow’s transformation of its identity approach comes as a strategic response to the fragmented digital identity landscape and the rapidly evolving needs of companies. This evolution strengthens IDnow’s position as a trusted name in fraud prevention and digital identity.

With the rising complexity of global fraud and compliance challenges, industries’ demands go beyond traditional Know-Your-Customer (KYC) services. Today, true trust requires real-time fraud prevention at multiple touchpoints and as a result, identity verification becomes a proactive defense mechanism rather than a one-time regulatory obligation.

“Trust is more than just an element of customer onboarding. Digital identities must remain secure and compliant in a constantly evolving market environment. Only then can they meet the demands of today’s digital landscape,” explains Andreas Bodczek, CEO of IDnow.

“Our new vision and strategic repositioning go far beyond traditional identity verification. We are creating an ecosystem where trust is embedded into every interaction, enabling businesses to gain a sustainable, competitive advantage in the global digital economy.”

Trust as the Foundation of Digital Identity

IDnow: Where Trust Powers Identity lays a strong foundation for the growth of the company. The key initiatives of this new mission include cementing business operations, streamlining processes, leveraging artificial intelligence (AI) for automation, and optimizing cost structures.

Founded in 2014, IDnow has evolved from a startup offering a revolutionary alternative to the PostIdent procedure into a global company. Its continuous adaptability and commitment to raising trust standards provide IDnow’s customers with a clear competitive advantage in the global digital economy.

A Central Platform for the Next Generation of Identity Verification

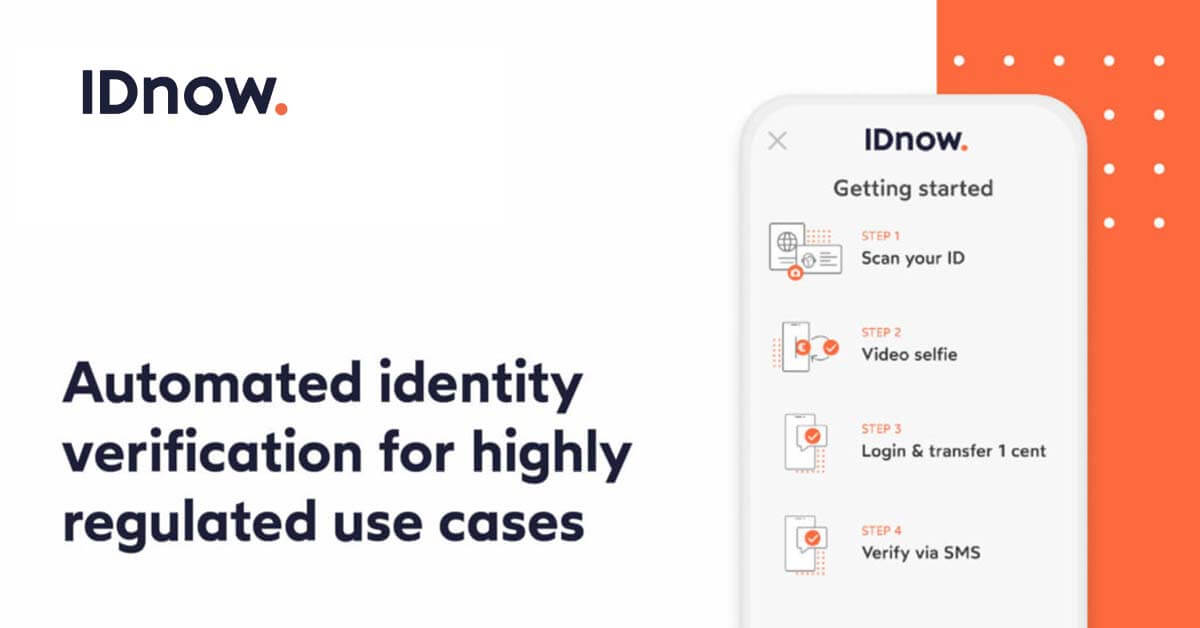

With AMLR and eIDAS 2.0 on the horizon, the digital identity landscape is becoming increasingly complex. In this context, IDnow is a one-stop shop, providing seamless access to electronic identities (eID), digital wallets, trust services, and all existing verification solutions.

IDnow plays a central role in the pan-European digital identity landscape. Its solutions simplify risk management, reduce regulatory complexity, and deliver customer-centric solutions. At the heart of this new vision, IDnow emerges as a key player in the next-generation identity verification ecosystem.

Positioned for the future

With this new strategic direction, IDnow specifically addresses the evolving risks that business operating in the global digital economy face today.

As cyberattacks grow in both frequency and sophistication, traditional security measures are often reactive and fail to provide the proactive defense needed. By prioritizing real-time fraud prevention and scalable security, IDnow is taking a forward-thinking approach to safeguarding businesses, ensuring that trust is embedded at every stage of the customer journey.

IDnow’s strategic shift allows companies to move from reactive to proactive security and implement a strong digital identity ecosystem. This approach, especially in highly regulated industries, creates crucial advantages while simultaneously optimizing the customer experience.

“A paradigm shift is taking place in the digital identity landscape: moving away from one-time verification towards a continuous security process,” summarizes Bodczek.

“IDnow is a leading expert in fraud prevention. With our new vision and strategic repositioning, we are redefining what it means to be a leader in digital identity. We are creating a scalable, intelligent trust framework that future-proofs businesses.

He concludes: “We help businesses stay one step ahead of tomorrow’s threats. The comprehensive suite of products in our ecosystem means our customers will benefit from seamless identity verification, real-time fraud protection, and continuous compliance, all while enhancing user experiences and conversion rates.”