TF Bank, founded in Sweden in 1987, is a European online bank. In Germany, it offers the fee-free TF Mastercard Gold and attractive savings products, including instant access savings and fixed-term deposit accounts.

Founded: 1987 | Employees: 500 | Customers: 400.000* | With IDnow since: 2020

TF BANK AT A GLANCE

Increase

In the conversion rate from application to customer

Decrease

In processing time with onboarding

Increase

In the conversion rate from application to customer

FINANCIAL SERVICES • EUROPE

TF Bank becomes #1 credit card provider with fastest account opening in Germany with IDnow’s AutoIdent QES

6 minutes read

TF Bank streamlined its onboarding with IDnow, replacing manual checks with an efficient, fully digital identity verification process. By automating key steps, TF Bank reduced operational workload, improved customer experience and gained the flexibility to expand across multiple European markets.

Challenges.

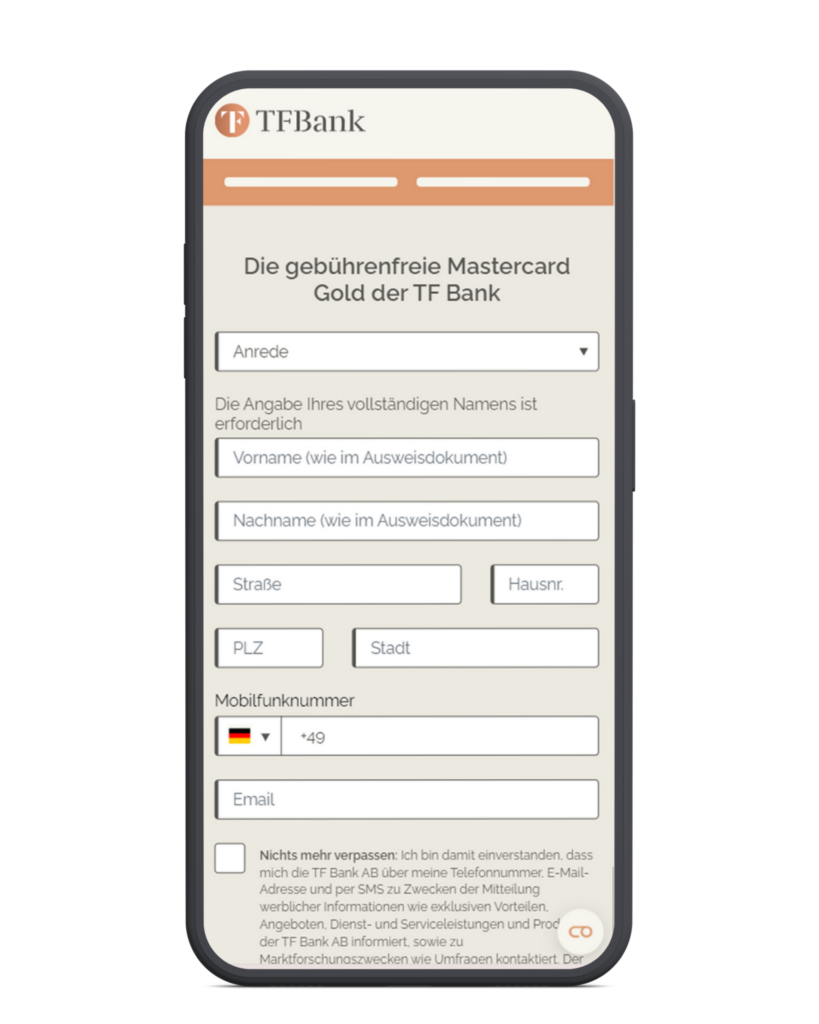

Before partnering with IDnow, TF Bank’s customer verification process was fragmented and largely manual, taking up to 7 days. For a short initial period after partnering with IDnow, TF Bank only used the Document capture and verification suite of AutoIdent, IDnow’s automated identity verification solution. However, our relationship took an iterative approach, and over time, TF Bank added more features and functionalities to further increase conversion rates and reduce onboarding times.

Their previous workflow for issuing credit cards required users to submit ID documents via their app, after which TF Bank manually handled the remaining verification steps. This included:

- Requesting customer selfies for identity verification.

- Manually matching them with photos from their ID documents.

- Sending contracts via email and subsequent following up for signatures.

- Managing compliance-heavy processes without automation.

This led to significant operational inefficiencies, increased workload for the TF Bank team and a suboptimal customer experience.

Why IDnow.

TF Bank chose IDnow for several key reasons:

Proven expertise in large-scale European deployments.

IDnow has extensive experience supporting major financial institutions with secure, scalable identity verification solutions.

Flexible verification journeys.

Combining automation with fallback options to manual review experts, reducing manual interventions while improving compliance and fraud prevention.

Industry-leading fraud prevention.

IDnow has a proven track record of stopping fraud, helping TF Bank stay ahead of emerging threats.

Regulatory excellence.

As a leading innovator, IDnow anticipates and adapts to regulatory changes, ensuring compliance with eIDAS 2.0, AMLD6, and other key regulations.

Seamless digital contract signing.

IDnow’s QTSP partnership enables secure and compliant electronic signatures within the verification process.

The solution.

Recognizing these inefficiencies through proactive account management, IDnow identified an opportunity to streamline their process by enhancing identity verification with automated biometric checks and instant Qualified Electronic Signature (QES) ensuring a seamless and compliant customer journey in line with European eIDAS standards. This enhanced solution not only automated the entire verification flow, including capturing user selfies and matching them to the photo on the ID document, but also enabled issuing QES for seamless and valid remote contract signing, required to complete the customer journey.

“Thanks to IDnow, we have become the market leader in our credit card segment. We manage to give our customers a credit decision in real time and verify the customer in real time.”

Julian Grötzbach, Head of Expansion Cards at TF Bank

Architecture and integration.

As a result, TF Bank has significantly reduced manual workload and improved the user experience, making credit card issuance faster and more seamless. Thanks to secure, real-time identity verification – lasting 2–5 minutes or sometimes as little as 30 seconds – customers receive instant credit decisions and can activate and use their cards immediately. This efficiency has positioned TF Bank as a market leader in its credit card segment, increasing its application-to-customer conversion rate by 10%.

Scaling success.

Following the initial success in the German market, TF Bank implemented IDnow’s AutoIdent QES to issue credit cards in additional markets, starting with Austria, followed by Italy. With the introduction of new services like instant money deposits, IDnow has been instrumental in facilitating TF Bank’s ongoing expansion and diversification of its online offerings in Europe. This collaboration extended to TF Bank’s partnership with Avarda, a subsidiary focused on providing flexible payment solutions such as instalment plans and buy now, pay later (BNPL) services, where IDnow’s AutoIdent QES solution are also implemented.

Fraud prevention.

To prevent data manipulation, document forgery, identity theft, and other fraudulent activities, IDnow’s AutoIdent QES conducts multiple verification checks, including:

- Basic document analysis (Expiry check, Age check, MRZ integrity check)

- Advanced document analysis (Cross-checks between VIZ and MRZ, Front and back side validation)

- Advanced authenticity check (Security features check)

- Advanced chip authenticity check (Chip check)

“I would recommend IDnow for many reasons – the collaboration is really fun, technically, we are operating at an advanced level, the speed of implementation is excellent, and the collaboration is also highly cost effective.”

Julian Grötzbach, Head of Expansion Cards at TF Bank

Regulatory compliance.

TF Bank’s partnership with IDnow ensures full compliance with the stringent EU Anti-Money Laundering Directive 6 (AMLD6) and Germany’s Geldwäschegesetz (GwG), reinforcing robust KYC (Know Your Customer) measures to prevent financial crime. In addition, the integration adheres to GDPR by implementing advanced encryption protocols and secure data storage practices to protect customer information. Additionally, compliance with DORA (Digital Operational Resilience Act) safeguards the bank’s IT infrastructure against cyber threats, while conforming with BaFin’s supervisory standards ensures stringent risk management and regulatory alignment in the German financial sector.

Technical support.

TF Bank benefits from a dedicated Customer Success Manager (CSM) and an Account Manager (ACM), ensuring expert assistance in resolving technical issues and providing hands-on guidance to maximize conversion rates and operational efficiency. They have direct access to IDnow’s ticketing system, allowing them to log in, create support tickets and track issue resolutions efficiently. Additionally, TF Bank can monitor their data, volumes and performance metrics in real-time through dedicated dashboards and reports.

Next steps.

TF Bank’s commitment to innovation drives their constant exploration of new products and opportunities. As an early adopter of IDnow Trust Services qTSP, they replaced their original qTSP, further streamlining the process and eliminating the need for SMS OTP. Building on the success of AutoIdent QES, TF Bank is now planning an SDK integration in 2025. This will embed IDnow’s verification process directly into their digital platform, removing external redirections and creating an even more seamless customer journey.