Address Verification: Understand where customers live.

A verified address is more than a formality – it’s a foundation for compliance, trust, and seamless service. IDnow Address Verification helps you confirm your customers’ residence with precision, using official documents and multi-channel workflows to meet regulatory requirements and keep your business secure.

Purpose built for trust, wherever your customers are.

From financial services and mobility to regulated retail and online marketplaces, address verification is a vital step for onboarding, compliance, and fraud prevention. IDnow combines document analysis, live specialist review, and smart automation to deliver address checks that are accurate, auditable, and easy for genuine users.

Deploy trust, your way.

Automated self-service.

Users upload a proof-of-address document—such as a utility bill or bank statement—via web, mobile, or API. Advanced OCR instantly extracts and verifies address details, matching them against user data for fast, accurate results and a seamless experience.

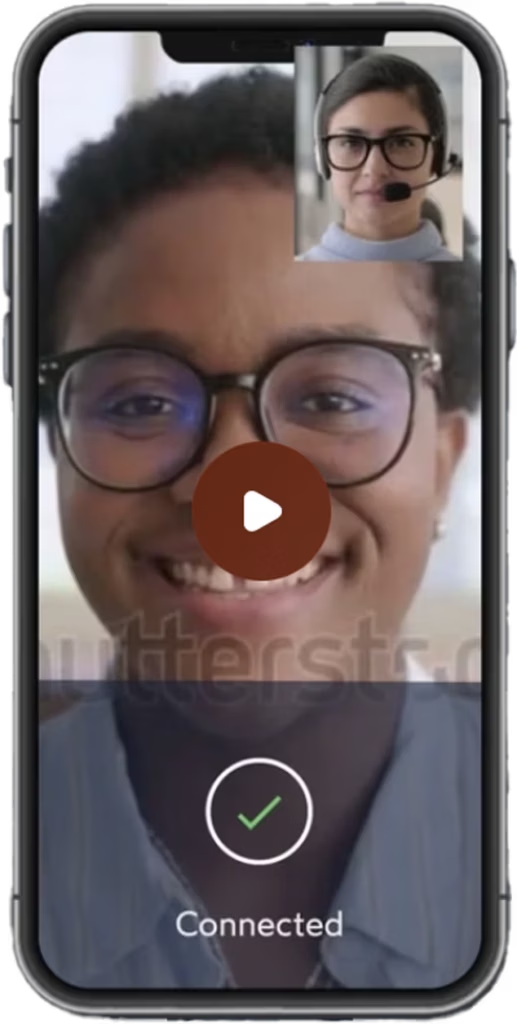

Expert-led verification.

In a live video call, a trained specialist visually inspects the proof-of-address document, confirms it matches the user’s details, and ensures authenticity and compliance. This hands-on approach delivers high-trust verification for regulated sectors.

Point of Service integration.

At physical locations, address data is captured automatically from ID documents using OCR or NFC technology. If automatic extraction isn’t possible, staff can photograph a proof-of-address – enabling quick, compliant checks wherever your customers are.

What we analyze

Here’s how we verify address data to ensure every customer is exactly where they claim to be.

Reality Check: Fraud in Action

A user uploads a digitally altered utility bill. Advanced OCR detects anomalies in the document layout and inconsistent data fields, instantly flagging the submission for further review and stopping fraudulent onboarding.

Reality Check: Compliance in Action

A user tries to register with an old address that doesn’t match their onboarding details. The system spots the mismatch between the extracted address and the expected data, and blocks the registration before it goes any further.

Reality Check: Compliance in Action

During a video call involving a user trying to onboard with a financial services provider, the specialist spots a proof-of-address document that’s outdated and doesn’t match the user’s name. The identification is canceled, ensuring the business remains compliant and secure.

Learn more about how we help you stay ahead of regulatory compliance.

Why businesses choose IDnow Address Verification:

- Multi-channel: automated, video, and POS options

- Global ID document coverage

- Support for structured and unstructured proof-of-address documents

- Advanced OCR and NFC for accurate and instant data extraction

- Manual and specialist review for compliance and accuracy

From Proof of Address to Proof of Trust.

Address verification is more than a checkbox – it’s proof that your customers are who and where they say they are. With IDnow, you can leverage cutting-edge automation, expert review, and real-time validation to transform a simple document into a foundation of trust. The result? Confident onboarding, airtight compliance, and enhanced protection against fraud.

Built to work in your world.

Integrate address verification into your onboarding, KYC or compliance flows with minimal effort. Whether you need SDK, API, or orchestration through the IDnow Identity Trust Platform, we deliver scalable, privacy-first checks for the modern digital business.

Verify address with certainty and speed.

Discover how address verification can power trust in your business.

Bring certainty to every customer interaction. With IDnow, address verification is fast, accurate, and built for real-world compliance – so you can onboard with confidence, protect your business from fraud, and give genuine users a truly seamless experience.